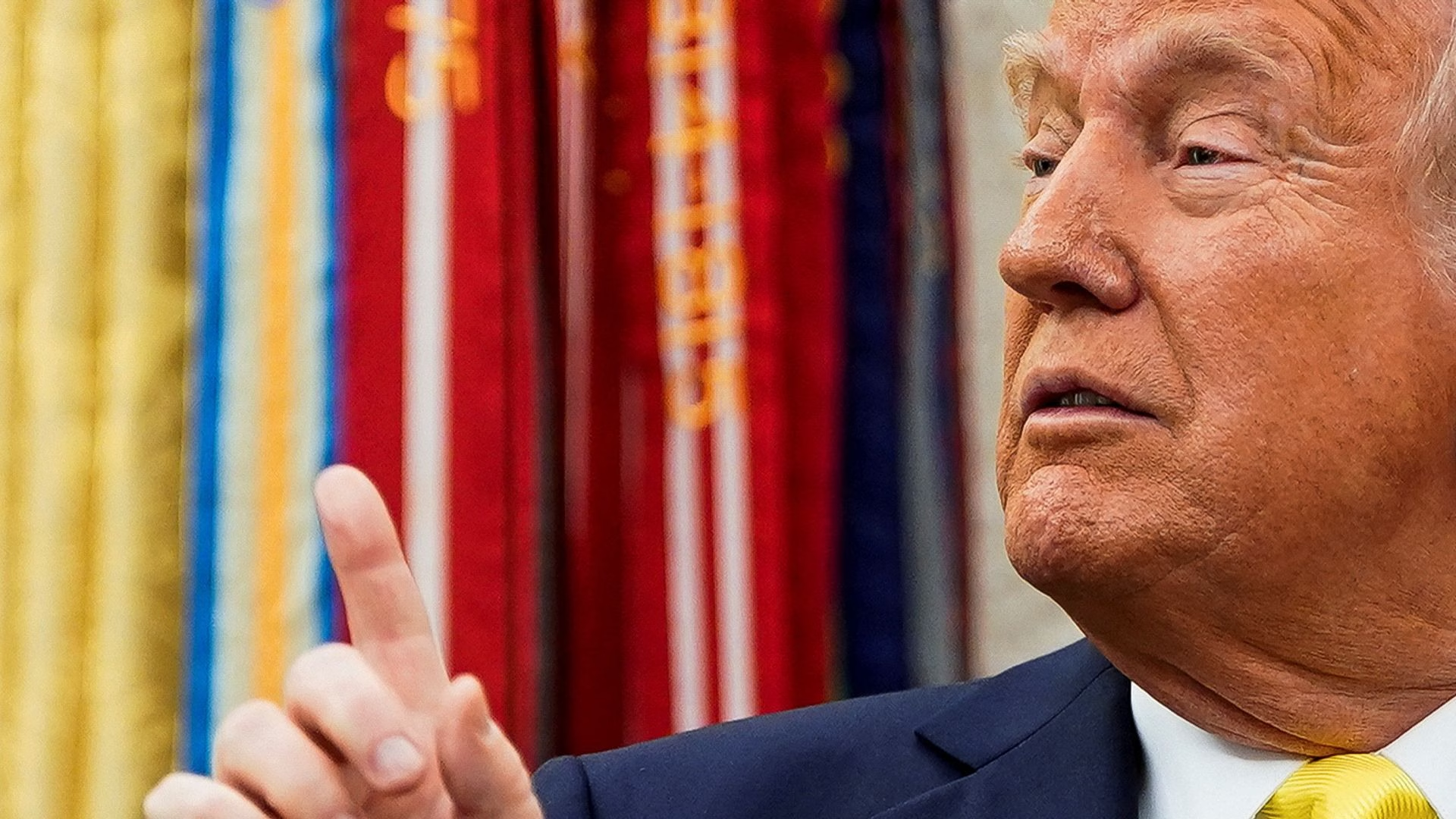

Wide-ranging new tariffs set to take effect next week by order of United States President Donald Trump could drive up prices in the Virgin Islands, but the measures are unlikely to directly impact the territory’s financial services and tourism sectors, experts said.

Within weeks of being sworn in as president on Jan. 20, Mr. Trump imposed 25 percent tariffs on a variety of Canadian and Mexican imports and 10 percent on Chinese goods coming into the US.

In a typically abrupt move, he then suspended the levies on Canada and Mexico for a month at the end of January as Beijing retaliated with its own sanctions on specific US products.

The White House upped the stakes in mid-February by announcing plans to impose a 25 percent tariff on all steel and aluminum imports to the US from March.

Mr. Trump then threatened to further target countries that impose value-added tax on US exports and floated the idea of a 25 percent tariff on imported pharmaceuticals.

On Tuesday, he added that a levy of “25 percent or higher” could be imposed on imported semiconductor chips, which power most electronic products.

Rising costs

Mr. Trump has promised that the tariffs will put “America first,” but his critics claim they will push up US prices and fuel inflation.

Such price rises to the north would have a knock-on effect here in the VI, Premier Natalio “Sowande” Wheatley warned recently.

“The costs of goods in the United States will have a direct impact on this territory as we are heavily reliant on goods imported from the United States,” Mr. Wheatley told the House of Assembly on Feb. 13.

In response to the threat, Mr. Wheatley added that the VI government is looking at importing more food from the Dominican Republic and increasing domestic agriculture.

“Looking ahead, we have initiatives to address potential cost-of-living hikes,” the premier said.

Chamber of Commerce

VI Chamber of Commerce Chairwoman Shaina Smith-Archer agreed that consumers here should prepare for rising prices.

“I expect that local businesses are already looking into diversifying their supply chain to mitigate the severity of the impacts, but consumers need to expect change,” she told the Beacon. “For example, the tariffs on aluminum can affect the price of soft drinks that are packaged in aluminum cans.”

Such impacts, she explained, are inevitable in response to global shifts.

“Changes in tariffs by the US or other countries in response to them will affect the price of imported goods and services because the Virgin Islands is connected to the global supply chain,” Ms. Smith-Archer said.

Tourism sector

Sharon Flax-Brutus, director of operations for Virgin Gorda Villa Rentals, said price hikes would hit the tourism industry by driving up the cost of living and disproportionately affecting hospitality workers at the lower end of the wage scale.

“I see it impacting on the cost of doing business. We are looking at what the grocery prices are, especially on the villa side, because a lot of our guests buy provisions,” she added. “Food prices: That’s where I see the biggest impact.”

Despite these impacts, however, Ms. Smith-Archer believes the hospitality trade in the VI has a strong brand that will keep attracting US visitors.

Asked if she is concerned fewer Americans would come to the territory as prices go up, Ms. Flax-Brutus told the Beacon, “I don’t think so. At least not where we sit as a luxury destination. Yes, it is that it may be a bit more expensive to travel to BVI, but I don’t see it impacting.”

UK a target?

Other impacts — including pressures on the territory’s financial services sector — could follow if Mr. Trump eventually decides to hit Britain with tariffs.

So far, he has not announced firm plans in that regard despite targeting the European Union. In one recent statement, in fact, he seemed to confuse the United Kingdom with the EU, which Britain exited five years ago.

“It will definitely happen with the European Union, because they have really taken advantage of us,” Mr. Trump said of his planned tariffs in early February. “So the UK is way out of line, and we’ll see if the UK — but the European Union is really out of line. UK is out of line, but … I think that one can be worked out. But the European Union, it’s an atrocity.”

Even if Mr. Trump does target the UK directly, the VI and other overseas territories may escape major impacts, according to Peter Clegg, a professor at the University of the West of England who studies the relationship between the UK and OTs.

“Of course, the BVI and other OTs might be impacted indirectly if the US tariffs slow global trade and financial flows, but direct impacts, even if the UK is targeted, may well be small,” Mr. Clegg told the Beacon.

Mr. Clegg also believes the likelihood of Mr. Trump targeting the UK is low. The president has accused Canada and the EU of enjoying huge trade surpluses with the US, which he has insisted must be brought down. But Mr. Clegg said the situation with the UK is more complex.

“The UK estimates it has a big trade surplus with the US, but the US estimates that it has a trade surplus with the UK,” he said. “The difference is over how trade flows are measured.”

Unlike the UK, he added, the US statistics include trade flows through crown dependencies.

“So with a trade surplus on that basis, the US might be less inclined to act,” he said.

Mr. Clegg added that this situation could help the territory and its financial services sector during a global economic storm.

“Looking at the tariffs imposed on China and those that were threatened on Canada and Mexico, there was a primary focus on goods imported for consumption, except for energy or energy services,” he said. “At this moment, financial services have not been discussed. If the focus remains on goods, then UK/OT financial services might be spared.”

He also highlighted the VI’s economic distance from the UK.

“I don’t believe the US includes the UK OTs in its statistics for the UK, so that gives the OTs some distance from the UK if the UK and potentially its financial services are targeted,” he added.

Financial services

VI-based asset-recovery lawyer Martin Kenney said he believes the territory’s financial sector has little to fear from Mr. Trump’s flexing of US economic muscles.

“I doubt that the BVI will be adversely affected by Trump other than in respect to harm done to the world’s economy in general if a global trade war is unleashed by Trump’s bellicose ‘might is right’ carry-on,” Mr. Kenney told the Beacon.

Blowback still possible

However, the attorney does expect some blowback if Mr. Trump goes after the UK.

“I imagine that any tariffs erected against the UK by Trump may have some collateral impact on the BVI,” he said.

Mr. Kenney also said the White House appears to have little interest in hitting overseas financial centres in general.

“My view is that the Trump administration is not going to spend much brain power attacking offshore financial centres like the BVI,” he said. “That does not accord with MAGA’s ethos.”

FSC boss

Financial Services Commission CEO Kenneth Baker also addressed the Trump question during an appearance on the Talking Points show on ZBVI Radio at the start of the month.

“We are still in the early days of the new US presidency,” he said. “We haven’t seen the impact trickle through as yet.”

Pressed about how the VI would react to an international trade war, Mr. Baker said the FSC is considering setting up another overseas office, like the one currently operating in Hong Kong, to promote the territory’s financial services industry.

Panama, he suggested, is a likely location for the office.

British Caribbean News